FakerDAO: An Exploration Of MakerDAO’s Governance Incentives

March 9, 2020 / Ben DiFrancesco

The MakerDAO project is one of the most interesting experiments in the crypto space. It pushes boundaries along multiple dimensions. Perhaps the most overlooked aspect of the project, at least until recently, is its governance.

Somehow, we seem to forget the “DAO” aspect of MakerDAO. Yet the decisions made by MKR token holders— a fluid community spread throughout the world— are some of the highest stakes votes in all of crypto. The Maker contracts secure well over half a Billion dollars of collateral, backing loans that yield nearly 150 Million dollars worth of the Dai and Sai stablecoins.

Countless other decentralized finance projects also integrate with Maker. From usage of Dai for payments, to reliance on the Dai Savings Rate to yield interest, a huge swath of Ethereum’s emerging DeFi ecosystem depends on the project.

A conservative estimate would be that over a Billion dollars worth of value hinges on the sound decision making of the MKR token holders in their executive votes. The case could be made for several Billion.

This post introduces a simple smart contract construction that demonstrates why the MakerDAO governance model, as currently conceived, may not be incentive compatible with the long term health of the Maker ecosystem. We have written this contract not to attack Maker, but to harden it.

We want to see Maker succeed, and in the words of Mariano Conti, “if it can be done, it will be done, and we need to prepare for it.” In fact, Mariano’s experiment with SelloutDAO, a one-time experiment for auctioning MolochDAO governance rights, was part of the inspiration for FakerDAO.

If contracts like ours represent a challenge to the long term stability of Maker & Dai, it’s best to discuss the issue as soon as possible and search for solutions together.

Introducing FakerDAO

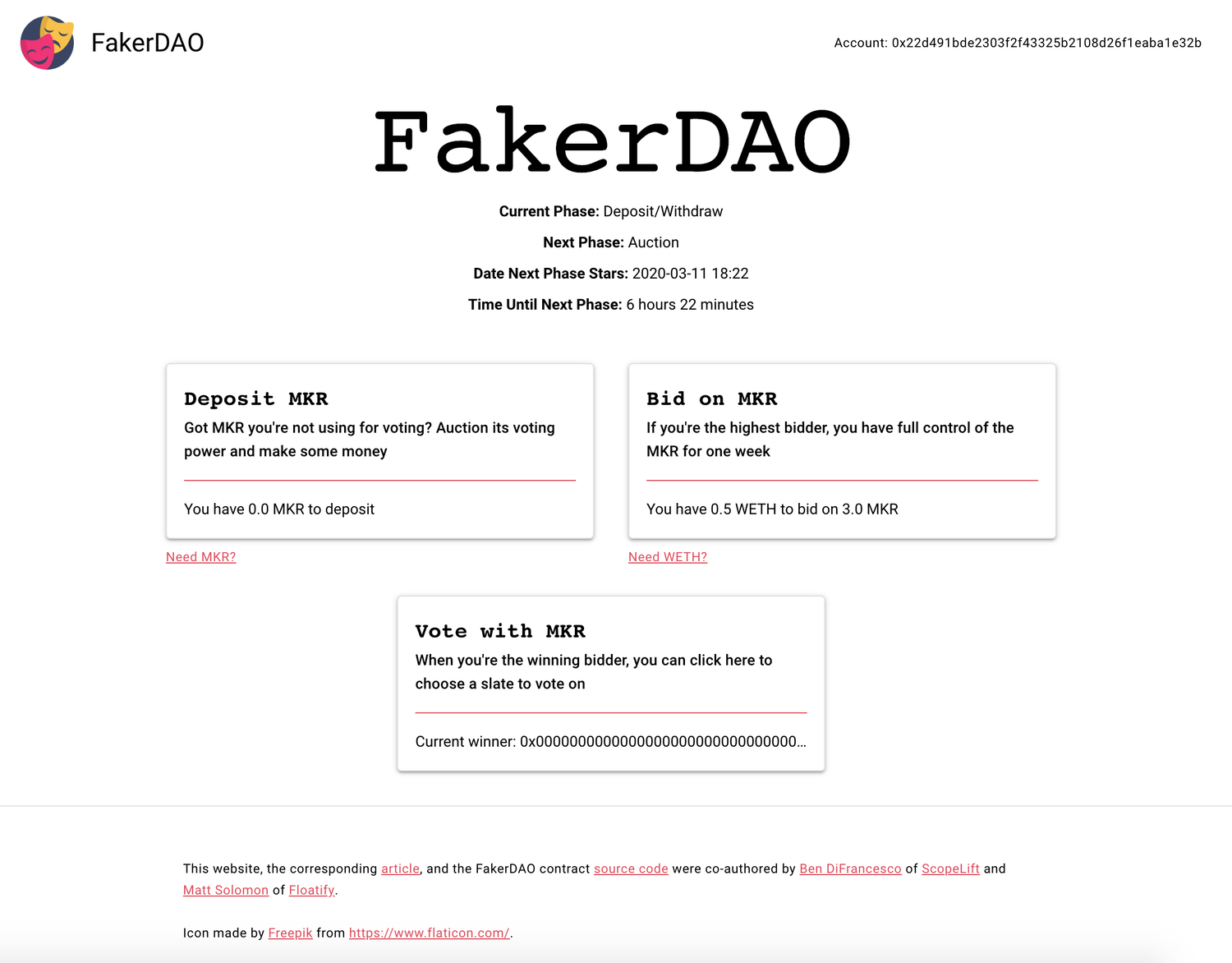

Today we are open sourcing the FakerDAO contracts & frontend, which we’ve also deployed to the Kovan testnet and made available at kovan.fakerdao.com. FakerDAO is a minimum viable implementation of a straightforward concept: pooling MKR tokens and selling their voting power to the highest bidder.

FakerDAO UI running on the Kovan testnet at kovan.fakerdao.com

Here are some of the details of FakerDAO.

Any MKR holder can lock their tokens in the contract.

Every seven days, the contract holds an auction in which anyone can submit bids denominated in ETH¹

The highest bidder wins the right to control the MKR locked in the contract for the next seven days.

MKR depositors are paid out after each auction for the proportion of the MKR they contributed.

At the end of each cycle, MKR withdraws/deposits are permitted, and the process starts again.

Maker uses a voting system referred to as “approval voting.” Token holders can choose up to 5 candidate proposals to vote for. They then stake their tokens to signal their approval for that “slate” of candidates. The proposal with the highest total stake at any time can be activated by anyone.

FakerDAO allows the winner of the most recent auction to choose which proposals the deposited MKR will support. The amount of MKR available to the winner is fixed for five days after the auction. At the end of five days, there is a one day deposit/withdrawal period, during which the MKR available may fluctuate up or down. After the deposit/withdrawal period, a one day auction period determines who will control the MKR next.

You may be wondering, why would a MKR holder deposit into the FakerDAO? The answer is simple: to earn a return on their MKR holdings.

Similarly, why would anyone bid to win the auction? As you’d guess, it’s to gain control of voting power at a cost well below that of actually buying the tokens. This could be for benevolent reasons (i.e. to support a proposal they believe is best for the Maker ecosystem), or for malicious ones (i.e. to use the voting power to attack the system in some way, including in the worst case, to drain the collateral).

The FakerDAO contract makes no value judgements about any of its participants or their intentions. It’s just code.

The Free Rider Problem

Just because it’s possible for MKR holders to auction their voting power doesn’t mean they will. Let’s examine the incentives.

The reasons for holding MKR tokens are twofold:

To earn a return on MKR when it appreciates in value, i.e. a speculative investment

To gain the right to participate in governance signaling

The system is designed to align and reinforce these two motivators. If the MKR holders make good decisions, and the system functions correctly, then MKR is burned in the process. As the total supply of MKR decreases, both the voting power and the value (in theory) of the remaining tokens will increase.

While cleverly designed, the system is susceptible to so-called free riders. Participating in governance takes effort. It involves following the proposals, understanding their impacts, weighing arguments for and against given changes, and staking tokens accordingly.

In theory, this effort might be “worth it” if one’s participation helps the DAO make good decisions and the system flourishes. The obvious issue is that a MKR holder who goes through all this effort receives the same reward as one who didn’t.

There is clear evidence of this dynamic already taking place. There are currently about 218,000 MKR signaling governance support of some kind, out of the 987,000 in the total supply. This means nearly 80% of existing tokens are sitting on the sidelines.

Worse Than Free Rider

The free rider problem is made worse by the possibility of contracts like the one we’ve presented here. By depositing their MKR into FakerDAO, passive holders not only stand to make the same gains (through appreciation) as those who actively participate in governance, they stand to earn more than active governance participants by extracting a rent from their tokens.

There is one technical detail that is critical to understand here. MKR tokens must be locked in the governance contract to signal approval. Therefore, any revenue generating use of the tokens, such as depositing in FakerDAO, is precluded by participation in governance. Active governance is now strictly less profitable than passive holding, even before considering the time and effort required to participate.

In fact, the situation is even worse than this. FakerDAO depositors aren’t just doing nothing, their actions detract from the security of the system. The price of purchasing voting power from FakerDAO would presumably remain well below the price of purchasing the tokens outright. Thus, FakerDAO depositors reduce the security of the Maker system by decreasing the cost for a would-be attacker.

Incompatible Incentives

In the final analysis, the situation appears to be something like a prisoner's dilemma combined with the free rider problem:

The best outcome for the protocol, and thus for MKR holders as a whole, relies on a large percentage of MKR holders participating actively, exercising prudential judgement, and staking their tokens to enact good governance decisions.

The best outcome for any individual MKR holder is achieved by ignoring governance altogether and extracting rents from their tokens, weakening Maker’s security in the process.

How will MKR holders behave when their own best interest is at odds with the system as a whole? Game theory suggests that in the long term, this dilemma will cause Maker’s governance to tend toward minimal participation and compromised security.

As stated at the outset of this post, we are fans of Maker. We want it to be successful. In that vein, we’ve developed FakerDAO and written this post in the hopes of highlighting a potential shortcoming in its governance structure.

Are our conclusions incorrect? We’d love to hear why! If not, what can be done to harden the project long term against such scenarios? We have some ideas ourselves, but we’d love to hear yours.

¹ In fact, the contract can be deployed with any ERC20 as the bidding token. To accept ETH, you would use WETH.

This article, and the FakerDAO contract source code, were co-authored by_Matt Solomon_ and_Ben DiFrancesco_ of_ScopeLift_.